Social Media

ALERTS

CALIFORNIA ELECTION ALERT !

Tuesday, September 14, 2021 is Recall Election Day in California.

Vote YES on the first question to RECALL GOVERNOR GAVIN NEWSOM; and

Vote for LARRY ELDER on the second question to elect Larry Elder as governor if a majority of the votes counted voted Yes on the first question.

Vote-By-Mail ballots were mailed out to ALL registered voters, dead or alive, moved out of the state or not, legal or illegal. This was done to maximize the opportunity for election fraud and theft to keep Governor Gavin Newsom in office.

The election fraud can include stuffing the ballot box with fraudulent ballots voting NO on the RECALL and NO VOTE for the new governor, and destroying, discarding, or not counting ballots voting YES and LARRY ELDER.

You can vote by mail, but it is probably safer to vote in person at the election poll on or before September 14, 2021 to help ensure your vote gets counted.

-

GREAT WEBSITES TO VISIT REGULARLY:

Prager U

Dennis Prager's 5-Minute Educational Videos

Free Videos. Free Minds. www.PragerU.com

KRLA AM 870 Talk Radio

AM870TheAnswer.com

KABC AM 790 Talk Radio

www.KABC.com

Mark Levin Radio Talk Show:

www.MarkLevinShow.com

Hear or download past shows for free:

www.MarkLevinShow.com/audio-rewind/

Meta

April 2024 M T W T F S S « Aug 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 -

Recent Posts

- Recall Racist and Undemocratic Governor Newsom, Elect Larry Elder – Letter to the El Segundo Herald by Michael D. Robbins

- America’s Founding Principles in 250 Words, Including the Title

- Former El Segundo City Councilman Mike Robbins Exposed Evidence of an El Segundo Unified School District Pay-For-Play Scam Involving Bond Measure ES

- Flyer Distributed throughout El Segundo exposing evidence of El Segundo Unified School District Pay-For-Play to Fund School Bond Ballot Measure ES Campaign

- Alert for the Tuesday, November 8, 2016 General Election

Recent Comments

- Why “Hate Crime” Laws are Immoral and Counter-Productive, by Michael D. Robbins | Public Safety Project™ on Hate Crime Law Supporters Weakened Our Criminal Justice System and Self-Defense Rights, by Michael D. Robbins

- El Segundo firefighter Michael Archambault arrested at Costco for allegedly shoplifting five products worth $354.95 (Booking Photo) | Public Safety Project™ on Could Firefighter’s Arrest be the Result of a Culture of Entitlement?

- Special Email – RE: Chevron Chamber Package – 1-4-2012.pdf – Adobe Acrobat Standard | Public Safety Project™ on Are Chevron’s Taxes Too High?

- Special Email – FW: Chevron Chamber Package – 1-4-2012.pdf – Adobe Acrobat Standard | Public Safety Project™ on Are Chevron’s Taxes Too High?

- Eye-Popping El Segundo 2009 City Employee Compensation Data Now Available | Public Safety Project on Eye-Popping El Segundo 2009 Firefighter Compensation Data

Archives

- August 2021

- June 2021

- November 2018

- August 2016

- May 2016

- April 2016

- March 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- January 2015

- October 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2013

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- March 2011

- February 2011

- January 2011

- December 2010

- October 2010

- September 2010

- August 2010

- January 2010

- October 2009

- April 2008

- August 2005

- August 2004

- April 2004

- August 2001

- July 2001

- April 1996

- March 1996

- January 1994

- November 1991

Categories

- 9-11 Terrorism Attack

- ALERTS

- America's Founding Documents

- America's Founding Principles

- American Founding

- ATM Machines

- Babies

- Banking

- Beach Reporter Letters

- Birds

- Bombings

- California

- Crime Control

- Crimes

- Daily Breeze Letters

- Declaration of Independence

- Democrats

- Doug Willmore's Great Chevron Shakedown

- Doug Willmore’s Great City Shakedown

- Economy and Economics

- El Segundo

- El Segundo Chevron Public Records Act Request

- El Segundo Election Coverage

- El Segundo Herald Letters

- El Segundo Hotel Transient Occupancy Tax (TOT)

- El Segundo Measure B TOT Tax Hike

- El Segundo News

- El Segundo Tax and Fee Increases

- Elections

- Elections

- Environment

- Ethics

- Fake News

- Federalist Papers

- Firefighter and Police Union Compensation and Pensions

- Firefighter Union Corruption

- Firefighters Commiting Crimes

- Fraud Waste and Abuse

- Genocide

- Government Employee Compensation and Pensions

- Gun Control

- Hermosa Beach

- Historical News

- Humor

- Identity Theft

- Individual Liberty

- Islamic Terrorism

- Israel

- Letters to the Editor

- Library

- Los Angeles Times

- Manhattan Beach

- Manhattan Beach News

- Mass Murders

- Measure A – 5 New Taxes and 6 Tax Inceases

- Measure P – Firefighters Union Initiative

- Middle East

- News

- Police Officers Commiting Crimes

- Police Union Corruption

- Political Corruption

- Politics

- Position Papers

- Public Records

- Public Records Act

- Recall Election

- Recall Election

- Redondo Beach

- Research

- RKBA

- School Teachers Union Corruption

- Security

- Self-Defense

- Self-Defense and Gun Rights

- Tax Policy and Issues

- Terrorism

- U.S. Constitution

- Uncategorized

- Union Corruption

- United States

- Videos

- Violent Crime

- Weapons of Mass Destruction

- Wildlife

Pages

Blogroll

- Documentation

El Segundo Police Officers' Association (ESPOA) Exposed

Response to the El Segundo Police Officers’ Association City Council Endorsements

El Segundo Police Officers' Association (ESPOA) Exposed

Response to the El Segundo Police Officers’ Association City Council Endorsements- Pension Tsunami Unfunded pension liabilities and excessive and unsustainable government pensions threaten bankruptcy.

- Plugins

- Suggest Ideas

- Support Forum

- Themes

- WordPress Blog

- WordPress Planet

Tag Archives: Transient Occupancy Tax

Mike Robbins’ Public Communications at the May 3, 2016 El Segundo City Council Meeting

First, I want to thank outgoing Mayor Pro Tem Carl Jacobson for his many decades of service to the City and the citizens of El Segundo, as Mayor, as Mayor Pro Tem, as Councilmember, on the Planning Commission, and in other capacities.

I had the privilege of serving on City Council with Carl Jacobson as mayor. We agreed on most issues, but when we disagreed, I always knew he was honest, intelligent, competent, and doing what he believed was in the best interest of the City and the citizens of El Segundo.

Second, I would like to congratulate the newly elected City Council Members, Don Brann, Carol Pirsztuk, and Drew Boyles. The City Council election turned out the way I believe will be best for our City. I am disappointed with the passage of Measure B, the 50 percent increase in the Hotel Transient Occupancy Tax.

I hope that increase in City tax revenue will not trigger a clause in the union contracts to give automatic additional COLA pay raises to the City employees. Such a clause existed in the previous union contracts. …

Any change in the way the mayor and mayor pro tem are elected should be based on what is best for the citizens of El Segundo, and should be put before the voters of El Segundo. All of the pros and cons of such a change should be carefully considered before putting the question before the voters. … Continue reading

Additional Arguments Against Measure B – El Segundo’s 50 Percent TOT Tax Hike

Here are the Additional Arguments Against Measure B, El Segundo’s 50 Percent TOT Tax Hike from 8% to 12%, on the April 12, 2016 El Segundo General Municipal Election ballot. These arguments are in addition to the Sample Ballot Argument … Continue reading

Gouging Hotels – Letter to the El Segundo Herald by Kip Haggerty

Gouging Hotels

To my dismay, I see the City Council has come back to us yet again with the immoral proposition of gouging hotel customers for the crime of not being us. The argument in favor is based on the bromide “every one else is doing it.” Anything higher than the sales tax rate is just plain wrong and I hope we have the collective wisdom to vote it down again. Instead of gouging visitors, we could always vote out the incumbents to keep any one from accumulating two terms and their associated health insurance for life benefit. This could save substantial funds for lifetime health care insurance of “retired” council members.

– Kip Haggerty

Continue reading

The Notorious Measure B – Letter to the El Segundo Herald by Edward Ryan

The Notorious Measure B

By now the USPS has brought us all a slick, full-color mailing which tells us to vote approval for the notorious Measure B. What a surprise: it is paid for by the cops’ and firemen’s PAC’s. Once again I urge my fellow residents to vote “No” and reject the 50% increase in the obnoxious TOT. We don’t need more taxes, we need fiscal responsibility. See you at the polls.

– Edward Ryan Continue reading

TOT aka Anti-Visitor Tax? – Letter to the El Segundo Herald by Edward Ryan

TOT aka Anti-Visitor Tax?

The transient occupancy tax (TOT) might be called the anti-visitor tax and is a nasty although widespread trend. It is now proposed to raise El Segundo’s TOT by 50% with the tired argument that it won’t cost us permanent residents anything, just make those outsiders pay. Of course, we will likely be hit with another city’s TOT, promoted by the same churlish reasoning, whenever we travel. So the net effect is a tax against anyone who doesn’t just sit at home. If surrounding cities have a higher TOT, fine, but we are proud of our safe and pleasant city and should only encourage more travelers to witness it. It is especially true because the proximity of LAX brings many foreign visitors into the neighborhood and they may well leave with a positive opinion of the United States if they experience El Segundo. Probably those visitors patronize our local businesses more than some of our cheapskate residents. And they must pay the high local sales tax. I urge my fellow citizens to reject the proposed increase. Within our city limits is a refinery operated by a corporation one of the world’s ten largest, if not in the top five, with enormous profits; we needn’t cast about for revenue sources.

– Edward Ryan

Continue reading

A Correction is In Order – Letter to the El Segundo Herald by Mike Robbins

A Correction is In Order

The 3/6/14 Herald article, “Council Holds Off on Rec and Parks Fee Decision”, contained misinformation. City property tax revenue is more than $6 million – not about $1 million as the author misinterpreted from Mayor Fisher’s obfuscation.

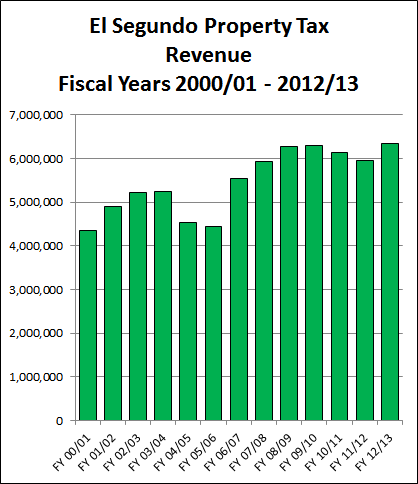

The property tax revenue numbers I cited at the 3/4/14 Council meeting are from official City of El Segundo public record documents and are presumably correct. Based on those documents, I stated during the meeting that El Segundo property tax revenue for fiscal year 2012/13 was more than $6.3 million, is at a record high for at least since FY 2000/01, is 46% and about $2 million higher than FY 2000/01, has had an average annual increase of 3.6% and more than $166,000 per year, and has increased in 9 of the last 13 fiscal years.

See the article, “Wrong Time to Raise Taxes and Fees in El Segundo”, at PublicSafetyProject.org. In includes a bar chart showing property tax revenue from FY 2000/01 through 2012/13, the data for that chart, and a link to the City public record document that is the source of that data.

Fisher wants voters to believe property tax revenue is to blame, not big pay raises. … Continue reading

Wrong Time to Raise Taxes and Fees in El Segundo

by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 3, 2014

Updated and expanded March 6, 2014.

This is the wrong time to raise taxes and fees on residents and businesses in El Segundo, for multiple reasons.

First, the existing three-year City employee union contracts are expiring later this year, and the City Council will negotiate new union contracts later this year after the April 8, 2014 City election. Raising taxes and fees before then will greatly weaken the City Council’s bargaining position with the unions, especially the politically active and extremely aggressive firefighter and police unions, which are the primary cause of the City’s financial problems.

Second, Mayor Bill Fisher and Councilmembers David Atkinson and Marie Fellhauer have claimed that the City’s financial problems are largely due to El Segundo receiving a lower percentage of the property taxes generated from property in the City than other cities in California receive.

That claim is false for multiple reasons.

The percentage of total property tax revenue generated in El Segundo that the City receives has not changed in many years, and the last time it changed, it went up due to the extraordinary efforts of Mayor Carl Jacobson. In fact, although El Segundo gets about 6.2% of the property tax revenues generated by property in the city, compared to the average of 11% for all 88 cities in Los Angeles County, El Segundo property values are much higher than the values in many other cities. The higher property values in El Segundo help compensate for the lower than average percent of property tax revenue allocated to the City of El Segundo.

But most striking is the fact that the City is receiving the highest amount of property tax revenues it has received in any year since fiscal year 2000/2001, and probably in the City’s entire history, as shown by the bar chart below. The FY 2012/2013 property tax revenue is at a record high of $6,332,163 – up by 46% and $1,994,509 above FY 2000/2001 property tax revenue. Property tax revenue has increased in 9 of the last 13 fiscal years, with an average yearly increase of 3.6% and $166,209.

Mayor Fisher and Councilmembers Atkinson and Fellhauer have repeatedly berated El Segundo residents for not paying enough property taxes. City residents paid about $20,770,813 in property taxes in FY 2012/2013, which is about 20.9% of the total, of which $1,287,790 came back to the City (about 6.2%). The 20.9% figure is not surprising given that only about 25% of the city’s land area is residential property and about 75% is industrial and commercial … Continue reading