Social Media

ALERTS

CALIFORNIA ELECTION ALERT !

Tuesday, September 14, 2021 is Recall Election Day in California.

Vote YES on the first question to RECALL GOVERNOR GAVIN NEWSOM; and

Vote for LARRY ELDER on the second question to elect Larry Elder as governor if a majority of the votes counted voted Yes on the first question.

Vote-By-Mail ballots were mailed out to ALL registered voters, dead or alive, moved out of the state or not, legal or illegal. This was done to maximize the opportunity for election fraud and theft to keep Governor Gavin Newsom in office.

The election fraud can include stuffing the ballot box with fraudulent ballots voting NO on the RECALL and NO VOTE for the new governor, and destroying, discarding, or not counting ballots voting YES and LARRY ELDER.

You can vote by mail, but it is probably safer to vote in person at the election poll on or before September 14, 2021 to help ensure your vote gets counted.

-

GREAT WEBSITES TO VISIT REGULARLY:

Prager U

Dennis Prager's 5-Minute Educational Videos

Free Videos. Free Minds. www.PragerU.com

KRLA AM 870 Talk Radio

AM870TheAnswer.com

KABC AM 790 Talk Radio

www.KABC.com

Mark Levin Radio Talk Show:

www.MarkLevinShow.com

Hear or download past shows for free:

www.MarkLevinShow.com/audio-rewind/

Meta

January 2025 M T W T F S S « Jun 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 -

Recent Posts

- Thank God America is NOT a Democracy!

- Recall Racist and Undemocratic Governor Newsom, Elect Larry Elder – Letter to the El Segundo Herald by Michael D. Robbins

- America’s Founding Principles in 250 Words, Including the Title

- Former El Segundo City Councilman Mike Robbins Exposed Evidence of an El Segundo Unified School District Pay-For-Play Scam Involving Bond Measure ES

- Flyer Distributed throughout El Segundo exposing evidence of El Segundo Unified School District Pay-For-Play to Fund School Bond Ballot Measure ES Campaign

Recent Comments

- Why “Hate Crime” Laws are Immoral and Counter-Productive, by Michael D. Robbins | Public Safety Project™ on Hate Crime Law Supporters Weakened Our Criminal Justice System and Self-Defense Rights, by Michael D. Robbins

- El Segundo firefighter Michael Archambault arrested at Costco for allegedly shoplifting five products worth $354.95 (Booking Photo) | Public Safety Project™ on Could Firefighter’s Arrest be the Result of a Culture of Entitlement?

- Special Email – RE: Chevron Chamber Package – 1-4-2012.pdf – Adobe Acrobat Standard | Public Safety Project™ on Are Chevron’s Taxes Too High?

- Special Email – FW: Chevron Chamber Package – 1-4-2012.pdf – Adobe Acrobat Standard | Public Safety Project™ on Are Chevron’s Taxes Too High?

- Eye-Popping El Segundo 2009 City Employee Compensation Data Now Available | Public Safety Project on Eye-Popping El Segundo 2009 Firefighter Compensation Data

Archives

- June 2024

- August 2021

- June 2021

- November 2018

- August 2016

- May 2016

- April 2016

- March 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- January 2015

- October 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2013

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- March 2011

- February 2011

- January 2011

- December 2010

- October 2010

- September 2010

- August 2010

- January 2010

- October 2009

- April 2008

- August 2005

- August 2004

- April 2004

- August 2001

- July 2001

- April 1996

- March 1996

- January 1994

- November 1991

Categories

- 9-11 Terrorism Attack

- ALERTS

- America's Founding Documents

- America's Founding Principles

- American Founding

- ATM Machines

- Babies

- Banking

- Beach Reporter Letters

- Birds

- Bombings

- California

- Conservative

- Crime Control

- Crimes

- Daily Breeze Letters

- Declaration of Independence

- Democrats

- Doug Willmore's Great Chevron Shakedown

- Doug Willmore’s Great City Shakedown

- Economy and Economics

- El Segundo

- El Segundo Chevron Public Records Act Request

- El Segundo Election Coverage

- El Segundo Herald Letters

- El Segundo Hotel Transient Occupancy Tax (TOT)

- El Segundo Measure B TOT Tax Hike

- El Segundo News

- El Segundo Tax and Fee Increases

- Elections

- Elections

- Environment

- Ethics

- Fake News

- Federalist Papers

- Firefighter and Police Union Compensation and Pensions

- Firefighter Union Corruption

- Firefighters Commiting Crimes

- Fraud Waste and Abuse

- Genocide

- Government Employee Compensation and Pensions

- Gun Control

- Hermosa Beach

- Historical News

- Humor

- Identity Theft

- Individual Liberty

- Islamic Terrorism

- Israel

- Leftist

- Letters to the Editor

- Library

- Los Angeles Times

- Manhattan Beach

- Manhattan Beach News

- Mass Murders

- Measure A – 5 New Taxes and 6 Tax Inceases

- Measure P – Firefighters Union Initiative

- Middle East

- News

- Police Officers Commiting Crimes

- Police Union Corruption

- Political Corruption

- Politics

- Position Papers

- Progressive

- Public Records

- Public Records Act

- Recall Election

- Recall Election

- Redondo Beach

- Republicans

- Research

- Right to Life

- RKBA

- School Teachers Union Corruption

- Security

- Self-Defense

- Self-Defense and Gun Rights

- Tax Policy and Issues

- Terrorism

- U.S. Constitution

- Uncategorized

- Union Corruption

- United States

- Videos

- Violent Crime

- Weapons of Mass Destruction

- Wildlife

Pages

Blogroll

- Documentation

El Segundo Police Officers' Association (ESPOA) Exposed

Response to the El Segundo Police Officers’ Association City Council Endorsements

El Segundo Police Officers' Association (ESPOA) Exposed

Response to the El Segundo Police Officers’ Association City Council Endorsements- Pension Tsunami Unfunded pension liabilities and excessive and unsustainable government pensions threaten bankruptcy.

- Plugins

- Suggest Ideas

- Support Forum

- Themes

- WordPress Blog

- WordPress Planet

Category Archives: Government Employee Compensation and Pensions

El Segundo Herald Misreports City’s $6.3 Million Property Tax Revenue as $1 Million

by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 8, 2014

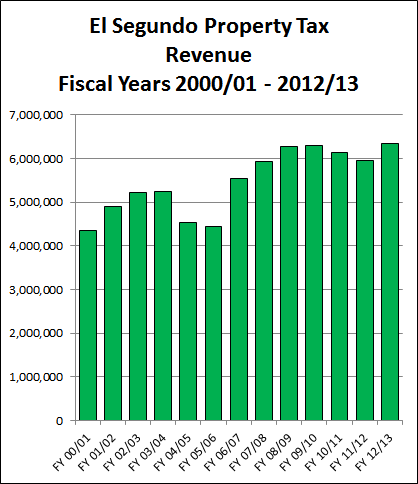

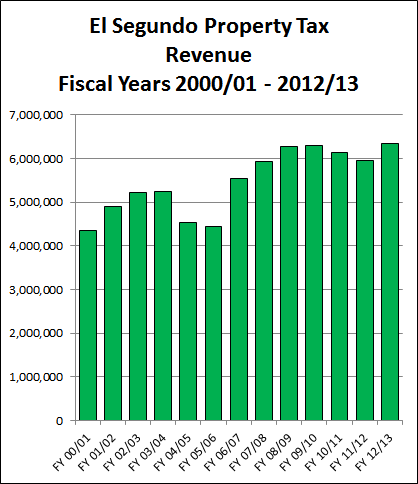

The El Segundo Herald, a small town newspaper in Southern California, misreported the City’s $6.3 million annual property tax revenue as “about $1 million”. A correction is in order. Given that gross understatement of property tax revenue, voters may vote for Measure A, a massive tax hike on the April 8, 2014 City election ballot that will cost residents and businesses an estimated $6.6 million each year in its first three years. All residents will pay the business taxes that are passed on to them as customers.

According to the March 6, 2014 Herald article, Council Holds Off on Rec and Parks Fee Decision, by Brian Simon:

“Responding to comments from former Councilmember Mike Robbins about the City’s property tax revenues being at an all-time high, Fisher responded that those dollars still only amount to two percent of the general fund, or about $1 million annually. El Segundo receives 6.2 cents on the dollar for its share of property tax revenues, compared to a County average of about 11 cents.”

That is a strange mistake, given my statements during Public Communications at the March 4, 2014 Council meeting that El Segundo property tax revenue for fiscal year 2012/13 was at a record high of $6.3 million, and that I posted an article with a bar chart showing El Segundo property tax revenue going back to fiscal year 2000/01 at PublicSafetyProject.org, in the article titled, Wrong Time to Raise Taxes and Fees in El Segundo. That article includes a table with the revenue data used to create the bar chart, and a link to the City Hall document from which the data was obtained.

Here’s that bar chart:

It’s worth noting that property values in El Segundo are probably significantly higher than most other cities in Los Angeles County, which helps compensate for the lower percentage of property taxes coming back to El Segundo compared to the average for cities in the county. The fact that property tax revenue is at a record high level shows property taxes are not the cause of Fisher’s budget deficits. Fisher gave big pay raises to City employees … Continue reading

El Segundo Measure A Co-Chair Joe Harding was Against the Tax Hikes Before He was For Them

by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 6, 2014

Joe Harding is one of two co-chairs identified on the “Yes on A for El Segundo’s Future” campaign committee website. Harding is also treasurer of the campaign committee as indicated on the first FPPC 460 campaign finance disclosure filed by the committee with the El Segundo City Clerk.

Harding was against the tax hikes before he was for them. He spoke out strongly against the tax hikes at the August 3, 2010 El Segundo City Council meeting when he was the General Manager of the Hacienda Hotel in El Segundo (HaciendaHotel.com). Now he is campaigning on the opposite side, for the tax hikes which hit hotels especially hard, as an ex-employee of the Hacienda. Here is an excerpt of what Harding said as a Hacienda Hotel employee:

“You must say ‘No’ to the hotel killer tax. … A TOT, and a UUT would hit us twice. That’d be like kicking us when we’re down, and then running us over for good measure. … The City must make unpopular and difficult adjustments to their payroll and expenses. Asking businesses to pick up the bill for the City and its residents in this economy is simply not a fair approach. The Hacienda has been and will remain a stellar business in this community. Help make sure this continues. Leave the TOT where it is. It’s working for us. It’s working for the City. … Thank you.” – Joe Harding, General Manager of the Hacienda Hotel in El Segundo, speaking at the August 3, 2010 El Segundo City Council meeting, before he became an ex-employee of the Hacienda, flip-flopped, and became a co-chair of the Yes on Measure A committee to raise both the TOT and UUT taxes on the Hacienda and all other hotels and businesses in El Segundo, and to impose them on residents.

Here is a video I made for the April 10, 2012 El Segundo City Council Election that includes Joe Harding’s full speech, starting at about time 3:28 to 5:46, followed by a transcript of his full speech. … Continue reading

El Segundo Firefighters’ Union is Bankrolling the Measure A Campaign to Hike Taxes

by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 6, 2014

The El Segundo Firefighters’ Association (the official name of the firefighters labor union) is bankrolling the “Yes on Measure A” campaign to create four new permanent Utility Users Taxes (UUTs) on residents, nearly double the four existing business UUTs, increase the hotel Transient Occupancy Tax (TOT, or “bed tax”) by 25%, and create a new 10% parking tax.

The “Yes on A for El Segundo’s Future” campaign committee filed its first campaign finance disclosure form, FPPC Form 460 (“Recipient Committee Campaign Statement”), with the El Segundo City Clerk on March 3, 2014. It reports $12,500.00 in total contributions received, including $5,500 monetary contributions and $7,000 in nonmonetary contributions. The committee reported spending $10,266.64. Those are large amounts of campaign money for small-town El Segundo with a population of only about 16,720 residents and about 10,784 registered voters. And that is just the beginning of their campaign!

The two monetary campaign contributions were a $5,000.00 contribution from the El Segundo firefighters Political Action Committee (PAC) and a $500.00 contribution from Sandra Jacobs, the current chairman of the El Segundo Chamber of Commerce, and a former El Segundo Councilmember and Mayor who ran as one of three firefighter and police union sponsored City Council candidates.

Here are the data entries from the Schedule A of the Form 460:

| DATE RECEIVED | CONTRIBUTOR | AMOUNT RECEIVED THIS PERIOD | CUMULATIVE TO DATE CALENDAR YEAR |

| 02/11/2014 | El Segundo Firefighters PAC (#1231824) P.O. BOX 55 El Segundo, CA 90245 |

$5,000.00 | $5,000.00 |

| 02/12/2014 | Sandra Jocobs 402 Hillcrest St. El Segundo, CA 90245 |

$500.00 | $500.00 |

Click HERE to view or download the “Yes on A” tax hikes FPPC Form 460 (536 KB PDF file).

Measure A will be decided by voters in the City of El Segundo, California on Tuesday, April 8, 2014. The El Segundo firefighter and police unions have much to gain in pay raises and increased pensions if Measure A passes. The two unions have a long history of endorsing, contributing money to, and campaigning for the City Council candidates and ballot measures that will put the most money in their paychecks and pensions, and then raise taxes and fees on residents and businesses to pay for it all.

The El Segundo firefighter and police unions have used this racket to ratchet up their total compensation to about $150,000 to more than $330,000 per individual per year.

The average 2009 firefighter annual individual total compensation was $211,000 and the maximum was $342,000 – before multiple large pay raises after 2009. The average 2009 police officer annual individual total compensation was $178,000 and the maximum was $304,000 – before multiple large pay raises after 2009. The firefighter and police managers get big pay raises when their subordinates get pay raises, to avoid “salary compaction”.

Police Chief David Cummings was given a 23% raise for his last year before retirement. As a result, he was paid a total of about $597,000 in 2009, the year he retired, in total Annual Compensation plus his CalPERS pension income while working half-time for 11 weeks as Police Chief after his retirement. His annual CalPERS pension income is now listed as $198,272.04 on the FixPensionsFirst.com web site.

The firefighter and police unions in El Segundo and other California cities have been pushing their city employers down the road towards bankruptcy. The City of Vallejo, California, is just one California city that filed for bankruptcy due to their firefighter and police unions. … Continue reading

Wrong Time to Raise Taxes and Fees in El Segundo

by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 3, 2014

Updated and expanded March 6, 2014.

This is the wrong time to raise taxes and fees on residents and businesses in El Segundo, for multiple reasons.

First, the existing three-year City employee union contracts are expiring later this year, and the City Council will negotiate new union contracts later this year after the April 8, 2014 City election. Raising taxes and fees before then will greatly weaken the City Council’s bargaining position with the unions, especially the politically active and extremely aggressive firefighter and police unions, which are the primary cause of the City’s financial problems.

Second, Mayor Bill Fisher and Councilmembers David Atkinson and Marie Fellhauer have claimed that the City’s financial problems are largely due to El Segundo receiving a lower percentage of the property taxes generated from property in the City than other cities in California receive.

That claim is false for multiple reasons.

The percentage of total property tax revenue generated in El Segundo that the City receives has not changed in many years, and the last time it changed, it went up due to the extraordinary efforts of Mayor Carl Jacobson. In fact, although El Segundo gets about 6.2% of the property tax revenues generated by property in the city, compared to the average of 11% for all 88 cities in Los Angeles County, El Segundo property values are much higher than the values in many other cities. The higher property values in El Segundo help compensate for the lower than average percent of property tax revenue allocated to the City of El Segundo.

But most striking is the fact that the City is receiving the highest amount of property tax revenues it has received in any year since fiscal year 2000/2001, and probably in the City’s entire history, as shown by the bar chart below. The FY 2012/2013 property tax revenue is at a record high of $6,332,163 – up by 46% and $1,994,509 above FY 2000/2001 property tax revenue. Property tax revenue has increased in 9 of the last 13 fiscal years, with an average yearly increase of 3.6% and $166,209.

Mayor Fisher and Councilmembers Atkinson and Fellhauer have repeatedly berated El Segundo residents for not paying enough property taxes. City residents paid about $20,770,813 in property taxes in FY 2012/2013, which is about 20.9% of the total, of which $1,287,790 came back to the City (about 6.2%). The 20.9% figure is not surprising given that only about 25% of the city’s land area is residential property and about 75% is industrial and commercial … Continue reading

April 8, 2014 El Segundo General Municipal Election News and Information

Last updated: Friday, May 9, 2014 at 01:45 AM PT.

This page will be updated regularly with links to informative articles about the upcoming April 8, 2014 El Segundo General Municipal Election.

Bookmark this page and review it often for breaking news and information.

(Posts are in priority order, not chronological order; newer posts appear in bold text.)

April 8, 2014 El Segundo General Municipal Election

Ballot Argument and Rebuttal Against El Segundo Measure A Tax Hikes

City of El Segundo 2014 Measure A Tax Hikes – City Attorney’s Impartial Analysis

Recapping the Election – Letter to The Beach Reporter by Michael Robbins

El Segundo Flyer #1: Vote “NO” on Measure A – Eleven Tax Hikes in One Measure!

El Segundo Flyer #3 – Vote “NO” on Measure A, and Against BILL FISHER!

El Segundo City Employee Unions Contributed $17,500 to Measure A Tax Hikes Thus Far

Have the Measure A Supporters Earned Our Trust?

City of El Segundo Can Save $3.3 Million Per Year in Employee Pension Costs

Welcome to the City of El Segundo $100K+ CalPERS Pension Club!

El Segundo Herald Misreports City’s $6.3 Million Property Tax Revenue as $1 Million

El Segundo Firefighters’ Union is Bankrolling the Measure A Campaign to Hike Taxes

El Segundo Measure A Co-Chair Joe Harding was Against the Tax Hikes Before He was For Them

Wrong Time to Raise Taxes and Fees in El Segundo

Which El Segundo City Employee was Paid Nearly $600,000 in His Last Year?

2009-2010 City of El Segundo Separations due to Budgetary Reasons Mostly Early Retirements

LETTERS TO THE EDITOR:

April 15 Council Meeting – Letter to the El Segundo Herald by Mike Robbins

Post-election Council meeting – Letter to The Beach Reporter by Michael Robbins

Council pay procedures – Letter to The Beach Reporter by Marianne Fong

Fellhauer is a Union Puppet – Letter to the El Segundo Herald by Marianne Fong

Can We Save Mayberry? – Letter to the El Segundo Herald by Marc Rener

Recapping the Election – Letter to The Beach Reporter by Michael Robbins

Fire Union Bankrolling “Yes on A” Campaign – Letter to the El Segundo Herald by Marianne Fong

No on Measure A – Letter to The Beach Reporter by Michael Robbins

Not happy with Measure A – Letter to The Beach Reporter by Marianne Fong

No on Measure A – Letter to the El Segundo Herald by Mike Robbins

Something Fishy About Measure A – Letter to the El Segundo Herald by Marianne Fong

NO ON “A” – Letter to the El Segundo Herald by Art Lavalle

A Correction is In Order – Letter to the El Segundo Herald by Mike Robbins

No on Measure A – Letter to the El Segundo Herald by Helen Armstrong

Frustration – Letter to the El Segundo Herald by Richard J. Switz

Measure ‘A’ – Letter to the El Segundo Herald by Richard J. Switz

Continue reading

Which El Segundo City Employee was Paid Nearly $600,000 in His Last Year?

by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 3, 2014

Firefighter and Police Unions are Breaking the City’s Budget

Generally, El Segundo sworn firefighters and police officers are by far the highest paid City employees. Their “associations” (unions) endorse, contribute money to, and campaign for the City Council candidates who will give them the biggest pay raises and increases in benefits and pensions, and then raise taxes and fees on residents and businesses to pay for it all. Their total compensation, including salary, benefits, and pension contributions paid by the City’s taxpayers, has been about $150,000 to more than $330,000 per individual per year.

The managers’ salaries, benefits, and pensions are increased along with those of their subordinates, to prevent “salary compaction”, and to maintain a minimum 5% higher level of compensation than their subordinates.

Existing sworn police and firefighter employees, including managers, can retire as early as age 50 (police) or 55 (firefighters) with a guaranteed annual pension income of up to 90% of their single highest year salary, including all the “Special Compensation” add-ons in their union contracts for things that are already a requirement of the job or are unrelated to the job.

Thus, Mayor Bill Fisher increased the employee pension income and the pension cost to the taxpayers for the police and firefighter employees (and for all City employees) every year of the Great Recession, because he gave them all excessive and unsustainable raises every one of those years!

City of El Segundo $100K Pension Club

Here is a list of retired El Segundo City employees in the “$100K Pension Club”, i.e., with CalPERS pensions paying them in excess of $100,000 per year guaranteed by the taxpayers regardless of pension fund investment performance:

http://www.FixPensionsFirst.com/calpers-database/?first_name=&last_name=&employer=EL+SEGUNDO

Highest Paid El Segundo City Employee in Calendar Year 2009

Former El Segundo Police Chief David Cummings was the highest paid City employee in calendar year 2009. He retired in 2009 with about eleven weeks left in the year, and had total 2009 compensation of about $596,657. This included his City contract income and his CalPERS pension income while he continued working as the El Segundo Police Chief after his retirement. Cummings’ post-retirement City employment contract acknowledged that he would be receiving his $210,000 per year CalPERS pension income while he continued working as the City’s police chief after his retirement. …

Continue reading

No New Taxes – Letter to The Beach Reporter by Marianne Fong

Please vote “yes” on Proposition 32 and “no” on all tax and bond measures, including 30 ($6 billion/year income and sales tax hike), 38 ($10 billion/year income tax hike), 39 ($1 billion/year tax hike); L.A. County Measure J (another 30 year sales tax hike), and El Camino Community College District Measure E ($350 million in new bond debt, probably costing about $700 million with interest).

Taxes are too high, and we also pay business taxes which are passed on to us as consumers. Bond measures create additional debt and require taxes to pay principle and interest. Bonds often cost double the amount borrowed with interest. … Continue reading

State Ballot Measures – Letter to The Beach Reporter by Michael D. Robbins

Please vote “yes” on Proposition 32 (bans direct union and corporate contributions to candidates) and “no” on Propositions 30 (income and sales tax hike), 34 (repeals death penalty), 36 (three-strikes dilution), 38 (income tax hike), and 40 (gerrymandered redistricting plan).

Proposition 32 helps prevent El Segundo and other South Bay and California cities from being pushed toward bankruptcy by city employee unions and corporations that buy influence with politicians who then pay them back with our tax money and raise our taxes and fees to pay for it. Typical payoffs are one million tax dollars for every thousand donated.

Corrupt and wildly overpaid firefighter and police unions are spending millions of dollars in deceptive campaign ads to defeat Proposition 32. These unions have been bankrupting our cities and jacking up our taxes and fees, so they can get total compensation of $150,000 to more than $300,000 per year, and retire at age 50 or 55, with a guaranteed pension paying up to 90 percent of their single highest year salary. … Continue reading

Stockton Syndrome Found – Letter to the El Segundo Herald by Douglas Heitkamp

El Segundo like many other cities in California appears to have some of the symptoms of an affliction now common throughout California. It has been observed in Vallejo, San Jose, San Diego, San Bernardino County and Stockton. I will refer to this malady as the “Stockton Syndrome”. Some of its symptoms include the lack of a balanced budget, loss of revenue from sales and real-estate taxes, investment income and electric utility tax. Other symptoms include unexpected personnel costs. Annual budges that must also cope with ever increasing yearly growth in salaries, pension and medical costs is common. Moody’s has taken notice of this in their recent announcement to review the bond ratings of all California cities. … Continue reading

New negotiation strategy – Letter to The Beach Reporter by Michael D. Robbins

Advice to the Hermosa Beach City Council for fire/police union contract negotiations to avoid bankruptcy:

Start negotiating from a blank sheet of paper to eliminate decades of union lawyer tricks and traps that ratcheted up costs.

Read, analyze, understand and price every provision and phrase in existing and new union contracts. Negotiate a not-to-exceed total contract cost based on specified staffing/service levels. Don’t write blank checks with taxpayer money as pension and insurance costs increase.

Do not base compensation on formulas involving compensation in other cities or costs will spiral upward. Do not give up inherent management rights to determine staffing levels, work assignments and layoffs, which are the city’s most important cost-control and bargaining tools.

Include a burden-sharing mechanism that includes thresholds and triggers which automatically reduce total contract costs by specified amounts, and optionally reopen negotiations, when unbudgeted, uncontrolled expenses and revenue declines exceed specified thresholds. … Continue reading