Social Media

ALERTS

CALIFORNIA ELECTION ALERT !

Tuesday, September 14, 2021 is Recall Election Day in California.

Vote YES on the first question to RECALL GOVERNOR GAVIN NEWSOM; and

Vote for LARRY ELDER on the second question to elect Larry Elder as governor if a majority of the votes counted voted Yes on the first question.

Vote-By-Mail ballots were mailed out to ALL registered voters, dead or alive, moved out of the state or not, legal or illegal. This was done to maximize the opportunity for election fraud and theft to keep Governor Gavin Newsom in office.

The election fraud can include stuffing the ballot box with fraudulent ballots voting NO on the RECALL and NO VOTE for the new governor, and destroying, discarding, or not counting ballots voting YES and LARRY ELDER.

You can vote by mail, but it is probably safer to vote in person at the election poll on or before September 14, 2021 to help ensure your vote gets counted.

-

GREAT WEBSITES TO VISIT REGULARLY:

Prager U

Dennis Prager's 5-Minute Educational Videos

Free Videos. Free Minds. www.PragerU.com

KRLA AM 870 Talk Radio

AM870TheAnswer.com

KABC AM 790 Talk Radio

www.KABC.com

Mark Levin Radio Talk Show:

www.MarkLevinShow.com

Hear or download past shows for free:

www.MarkLevinShow.com/audio-rewind/

Meta

April 2024 M T W T F S S « Aug 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 -

Recent Posts

- Recall Racist and Undemocratic Governor Newsom, Elect Larry Elder – Letter to the El Segundo Herald by Michael D. Robbins

- America’s Founding Principles in 250 Words, Including the Title

- Former El Segundo City Councilman Mike Robbins Exposed Evidence of an El Segundo Unified School District Pay-For-Play Scam Involving Bond Measure ES

- Flyer Distributed throughout El Segundo exposing evidence of El Segundo Unified School District Pay-For-Play to Fund School Bond Ballot Measure ES Campaign

- Alert for the Tuesday, November 8, 2016 General Election

Recent Comments

- Why “Hate Crime” Laws are Immoral and Counter-Productive, by Michael D. Robbins | Public Safety Project™ on Hate Crime Law Supporters Weakened Our Criminal Justice System and Self-Defense Rights, by Michael D. Robbins

- El Segundo firefighter Michael Archambault arrested at Costco for allegedly shoplifting five products worth $354.95 (Booking Photo) | Public Safety Project™ on Could Firefighter’s Arrest be the Result of a Culture of Entitlement?

- Special Email – RE: Chevron Chamber Package – 1-4-2012.pdf – Adobe Acrobat Standard | Public Safety Project™ on Are Chevron’s Taxes Too High?

- Special Email – FW: Chevron Chamber Package – 1-4-2012.pdf – Adobe Acrobat Standard | Public Safety Project™ on Are Chevron’s Taxes Too High?

- Eye-Popping El Segundo 2009 City Employee Compensation Data Now Available | Public Safety Project on Eye-Popping El Segundo 2009 Firefighter Compensation Data

Archives

- August 2021

- June 2021

- November 2018

- August 2016

- May 2016

- April 2016

- March 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- January 2015

- October 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2013

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- March 2011

- February 2011

- January 2011

- December 2010

- October 2010

- September 2010

- August 2010

- January 2010

- October 2009

- April 2008

- August 2005

- August 2004

- April 2004

- August 2001

- July 2001

- April 1996

- March 1996

- January 1994

- November 1991

Categories

- 9-11 Terrorism Attack

- ALERTS

- America's Founding Documents

- America's Founding Principles

- American Founding

- ATM Machines

- Babies

- Banking

- Beach Reporter Letters

- Birds

- Bombings

- California

- Crime Control

- Crimes

- Daily Breeze Letters

- Declaration of Independence

- Democrats

- Doug Willmore's Great Chevron Shakedown

- Doug Willmore’s Great City Shakedown

- Economy and Economics

- El Segundo

- El Segundo Chevron Public Records Act Request

- El Segundo Election Coverage

- El Segundo Herald Letters

- El Segundo Hotel Transient Occupancy Tax (TOT)

- El Segundo Measure B TOT Tax Hike

- El Segundo News

- El Segundo Tax and Fee Increases

- Elections

- Elections

- Environment

- Ethics

- Fake News

- Federalist Papers

- Firefighter and Police Union Compensation and Pensions

- Firefighter Union Corruption

- Firefighters Commiting Crimes

- Fraud Waste and Abuse

- Genocide

- Government Employee Compensation and Pensions

- Gun Control

- Hermosa Beach

- Historical News

- Humor

- Identity Theft

- Individual Liberty

- Islamic Terrorism

- Israel

- Letters to the Editor

- Library

- Los Angeles Times

- Manhattan Beach

- Manhattan Beach News

- Mass Murders

- Measure A – 5 New Taxes and 6 Tax Inceases

- Measure P – Firefighters Union Initiative

- Middle East

- News

- Police Officers Commiting Crimes

- Police Union Corruption

- Political Corruption

- Politics

- Position Papers

- Public Records

- Public Records Act

- Recall Election

- Recall Election

- Redondo Beach

- Research

- RKBA

- School Teachers Union Corruption

- Security

- Self-Defense

- Self-Defense and Gun Rights

- Tax Policy and Issues

- Terrorism

- U.S. Constitution

- Uncategorized

- Union Corruption

- United States

- Videos

- Violent Crime

- Weapons of Mass Destruction

- Wildlife

Pages

Blogroll

- Documentation

El Segundo Police Officers' Association (ESPOA) Exposed

Response to the El Segundo Police Officers’ Association City Council Endorsements

El Segundo Police Officers' Association (ESPOA) Exposed

Response to the El Segundo Police Officers’ Association City Council Endorsements- Pension Tsunami Unfunded pension liabilities and excessive and unsustainable government pensions threaten bankruptcy.

- Plugins

- Suggest Ideas

- Support Forum

- Themes

- WordPress Blog

- WordPress Planet

Tag Archives: revenue

A Correction is In Order – Letter to the El Segundo Herald by Mike Robbins

A Correction is In Order

The 3/6/14 Herald article, “Council Holds Off on Rec and Parks Fee Decision”, contained misinformation. City property tax revenue is more than $6 million – not about $1 million as the author misinterpreted from Mayor Fisher’s obfuscation.

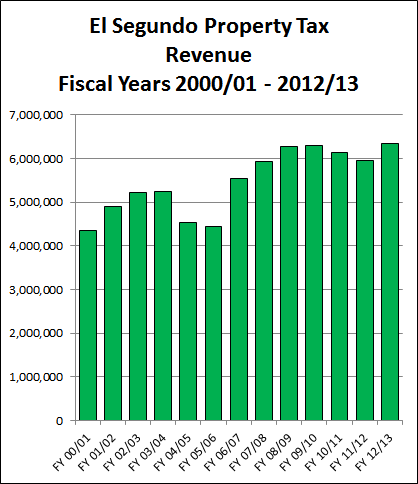

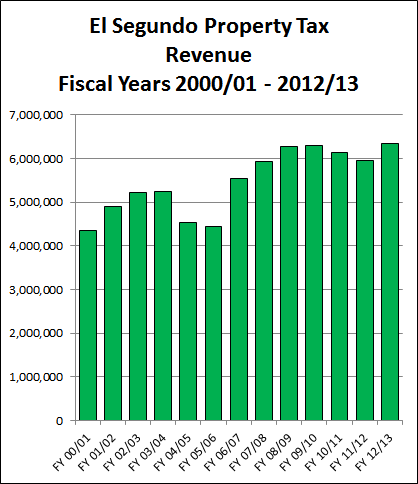

The property tax revenue numbers I cited at the 3/4/14 Council meeting are from official City of El Segundo public record documents and are presumably correct. Based on those documents, I stated during the meeting that El Segundo property tax revenue for fiscal year 2012/13 was more than $6.3 million, is at a record high for at least since FY 2000/01, is 46% and about $2 million higher than FY 2000/01, has had an average annual increase of 3.6% and more than $166,000 per year, and has increased in 9 of the last 13 fiscal years.

See the article, “Wrong Time to Raise Taxes and Fees in El Segundo”, at PublicSafetyProject.org. In includes a bar chart showing property tax revenue from FY 2000/01 through 2012/13, the data for that chart, and a link to the City public record document that is the source of that data.

Fisher wants voters to believe property tax revenue is to blame, not big pay raises. … Continue reading

El Segundo Herald Misreports City’s $6.3 Million Property Tax Revenue as $1 Million

by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 8, 2014

The El Segundo Herald, a small town newspaper in Southern California, misreported the City’s $6.3 million annual property tax revenue as “about $1 million”. A correction is in order. Given that gross understatement of property tax revenue, voters may vote for Measure A, a massive tax hike on the April 8, 2014 City election ballot that will cost residents and businesses an estimated $6.6 million each year in its first three years. All residents will pay the business taxes that are passed on to them as customers.

According to the March 6, 2014 Herald article, Council Holds Off on Rec and Parks Fee Decision, by Brian Simon:

“Responding to comments from former Councilmember Mike Robbins about the City’s property tax revenues being at an all-time high, Fisher responded that those dollars still only amount to two percent of the general fund, or about $1 million annually. El Segundo receives 6.2 cents on the dollar for its share of property tax revenues, compared to a County average of about 11 cents.”

That is a strange mistake, given my statements during Public Communications at the March 4, 2014 Council meeting that El Segundo property tax revenue for fiscal year 2012/13 was at a record high of $6.3 million, and that I posted an article with a bar chart showing El Segundo property tax revenue going back to fiscal year 2000/01 at PublicSafetyProject.org, in the article titled, Wrong Time to Raise Taxes and Fees in El Segundo. That article includes a table with the revenue data used to create the bar chart, and a link to the City Hall document from which the data was obtained.

Here’s that bar chart:

It’s worth noting that property values in El Segundo are probably significantly higher than most other cities in Los Angeles County, which helps compensate for the lower percentage of property taxes coming back to El Segundo compared to the average for cities in the county. The fact that property tax revenue is at a record high level shows property taxes are not the cause of Fisher’s budget deficits. Fisher gave big pay raises to City employees … Continue reading

Wrong Time to Raise Taxes and Fees in El Segundo

by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 3, 2014

Updated and expanded March 6, 2014.

This is the wrong time to raise taxes and fees on residents and businesses in El Segundo, for multiple reasons.

First, the existing three-year City employee union contracts are expiring later this year, and the City Council will negotiate new union contracts later this year after the April 8, 2014 City election. Raising taxes and fees before then will greatly weaken the City Council’s bargaining position with the unions, especially the politically active and extremely aggressive firefighter and police unions, which are the primary cause of the City’s financial problems.

Second, Mayor Bill Fisher and Councilmembers David Atkinson and Marie Fellhauer have claimed that the City’s financial problems are largely due to El Segundo receiving a lower percentage of the property taxes generated from property in the City than other cities in California receive.

That claim is false for multiple reasons.

The percentage of total property tax revenue generated in El Segundo that the City receives has not changed in many years, and the last time it changed, it went up due to the extraordinary efforts of Mayor Carl Jacobson. In fact, although El Segundo gets about 6.2% of the property tax revenues generated by property in the city, compared to the average of 11% for all 88 cities in Los Angeles County, El Segundo property values are much higher than the values in many other cities. The higher property values in El Segundo help compensate for the lower than average percent of property tax revenue allocated to the City of El Segundo.

But most striking is the fact that the City is receiving the highest amount of property tax revenues it has received in any year since fiscal year 2000/2001, and probably in the City’s entire history, as shown by the bar chart below. The FY 2012/2013 property tax revenue is at a record high of $6,332,163 – up by 46% and $1,994,509 above FY 2000/2001 property tax revenue. Property tax revenue has increased in 9 of the last 13 fiscal years, with an average yearly increase of 3.6% and $166,209.

Mayor Fisher and Councilmembers Atkinson and Fellhauer have repeatedly berated El Segundo residents for not paying enough property taxes. City residents paid about $20,770,813 in property taxes in FY 2012/2013, which is about 20.9% of the total, of which $1,287,790 came back to the City (about 6.2%). The 20.9% figure is not surprising given that only about 25% of the city’s land area is residential property and about 75% is industrial and commercial … Continue reading

A Message From Chevron El Segundo Refinery General Manager Frank Semancik

Subject: A Message From Chevron El Segundo Refinery General Manager Frank Semancik

From: Chevron El Segundo General Manager, Frank Semancik (XXXXXXXX@chevron.com)

To:

Cc:

Bcc:

Date: Friday, March 16, 2012 9:39 PM

Dear Community Leader,

Chevron is proud of the long tradition of trust and mutual respect we have with the City of El Segundo as well as the other neighbor cities and residents in the South Bay. We strive to conduct our business with the high moral values reflected in the community and, we sincerely believe we have demonstrated that commitment consistently over the 100 years our company has operated its facility in our hometown, El Segundo.

That is why it has been so disheartening and disappointing that in recent weeks, some have chosen to use deceptive tactics focused on Chevron to try and sway a local election and pit neighbor against neighbor. “Anonymous” special interests are seeking to drag our community into a debate on issues long settled by the elected representatives of the City of El Segundo. In doing so, they have completely ignored this key fact: Chevron has publicly stated its 100% commitment to work collaboratively with the City of El Segundo to resolve issues about the City’s tax structure discussed at the Council’s December 20, 2011 meeting.

We feel it’s important to set the record straight. Here are the facts:

- The unsubstantiated rumors and allegations concerning the utility user taxes (UUT) Chevron pays in El Segundo are false and fail to accurately reflect the public record.

- The distorted figure alleged to depict our UUT contribution to the City of El Segundo represents only a small portion of the almost $2 million Chevron pays annually in combined UUT’s.

- Chevron’s agreement with the City is not unique, and is in fact similar to the UUT bills companies like ours pay in other local cities, including the City of Los Angeles.

- The UUT issue being deceptively portrayed was reviewed in an open and public process with the full understanding of the City of El Segundo’s elected officials and City legal staff.

- Public records clearly demonstrate that the City UUT ordinance was made available for public review, certified, approved, adopted, signed and attested to during a regular and open meeting of the City Council. And most importantly, the UUT ordinance was approved by every member of the City Council.

We again commit to being open and honest in our communications and, as always, welcome your interest as our valued community partner. Thank you for allowing us to set the record straight.

Sincerely,

Frank Semancik, on behalf of the Chevron El Segundo Refinery, joined by Rod Spackman, Lily Craig, Jill Brunkhardt and Jeff Wilson Continue reading

Excerpts from the March 1, 2012 El Segundo Herald Article on Chevron

Asked about the lack of response to Willmore and if he had formed a legal opinion on the Chevron matter, El Segundo City Attorney Mark Hensley said he could not disclose information due to attorney/client privilege. However, he pointed out that for events “that happened 20 years ago and based on statutes that go back a quarter of a century, the process of reviewing all that is lengthy. There are statute of limitations issues…Had I been asked about something that happened 20 years ago, it would take a considerable amount of time to study it.”

A Council member in 1993, Mike Robbins confirmed that “the City was going to get sued by MRC, Chevron or both—and reached a legal settlement where the City paid MRC a reduced amount, Chevron effectively paid the City the amount paid to MRC, and Chevron’s future tax liability was more clearly defined.” Robbins went on to describe MRC’s approach as “hostile and aggressive,” and felt the firm “endangered the City’s business retention and attraction program.”

Asked to elaborate why the UUT deal with Chevron was fair, Robbins explained that El Segundo is a low-tax city by choice and can’t be compared to other municipalities. He added that Chevron is a unique case because its giant 951-acre parcel is self-contained. “The City does not pay to provide and maintain all the City infrastructure and services on the massive Chevron property that it provides for all the other business and residential properties in town,” Robbins said. “These include many miles of roads, alleys, sidewalks, storm drains, water and sewer pipes, street lighting, trees, landscaping, street sweeping, residential trash collection, and police patrols, as well as public parks and recreation facilities. It is not fair to charge Chevron taxes for City infrastructure and services that it does not receive.”

Meanwhile Councilmember Jacobson, who was El Segundo’s Mayor at the time of the settlement, described MRC as a “bounty hunter” since the company stood to make a 25 percent fee. “They were trying to charge Chevron for its own gas and the Council didn’t agree,” he said. Jacobson maintained that the Chevron UUT settlement was approved in public—not closed—session. “There was nothing secret about it.” … Continue reading

Are Chevron’s taxes too high? – Letter to the Daily Breeze by Michael D. Robbins

Are Chevron’s taxes too high?

El Segundo’s shakedown of Chevron under threat of a $10 million annual tax hike must stop, or the city will suffer long-term damage to its reputation. City Manager Doug Willmore used a deceptive, one-sided analysis for the Chevron property, rather than a cost-versus-benefits analysis. It’s dishonest to compare tax revenues generated per acre by the refinery with that of other local businesses. Unlike El Segundo, land use in other South Bay cities is mostly residential. Willmore ignored the cost to provide and maintain infrastructure and services for all the residents and businesses that would otherwise exist on the Chevron property if the refinery never existed. And he reduced Chevron’s tax revenue per acre by failing to account for the area of all the public streets, alleys, parks, and schools that would be needed.

If an accurate analysis shows Chevron’s taxes are excessive, will the City Council reduce Chevron’s taxes and apologize? … Continue reading

El Segundo making Chevron’s taxes too high – Letter to the Beach Reporter by Michael D. Robbins

El Segundo making Chevron’s taxes too high

The city manager’s Chevron Shakedown must stop, including efforts to extort large “gifts” of money under threat of a $10 million annual tax hike. The city will suffer long-term damage to its reputation as a good city to locate a business.

Doug Willmore used false premises to construct a deceptive one-sided analysis for the Chevron property, rather than a true cost-versus-benefits analysis. It is unfair and dishonest to compare tax revenues generated per acre by the Chevron refinery with that of other local businesses. Land use in other South Bay cities is mostly residential and not three-quarters commercial/industrial as in El Segundo.

In his one-sided analysis, Willmore ignored the cost for the city to provide and maintain infrastructure and services for residents and businesses that would otherwise exist on the massive Chevron refinery property.

If the refinery never existed, that land would be mostly residential and some commercial. Tax revenues would be much less, and the city would have to provide and maintain infrastructure and services for twice as many residents at great expense that Willmore failed to include in his seriously flawed and biased analysis. … Continue reading

Proposed Tax Increase On Chevron – Letter to the El Segundo Herald by Ron Murray

The proposed tax increase is flawed. The tax proposed is on land ownership, not on the business. The County taxes property— land and improvements of which El Segundo receives a “slice”. Taxes should be uniform and consistent; so the tax should be applied to all unimproved land in the city—parking lots, unimproved commercial zoned property, empty storage lots, etc., not just on Chevron.

Most business in El Segundo pay a business tax based on commercial building footage plus number of employees/contractors. This formula is good as it is tied to services provided by the city to the business. … Continue reading

Good Neighbors – Letter to the El Segundo Herald by Chris Powell

Many who work closely with the City on fiscal issues were surprised when a proposed tax increase on Chevron showed up on the Council’s agenda with no warning. … Continue reading

Chevron Tax – Letter to the El Segundo Herald by Joe harding

It’s disappointing that a majority of the City Council feel compelled to raise taxes on El Segundo’s oldest business without taking the time to consider the consequences not only for Chevron but for other businesses here.

Why, in a last-minute agenda addition just five days before Christmas, would the Council vote to draft an initiative for millions in new taxes, with a deadline of January 13 to decide whether or not to place it on the ballot? … Continue reading