by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 6, 2014

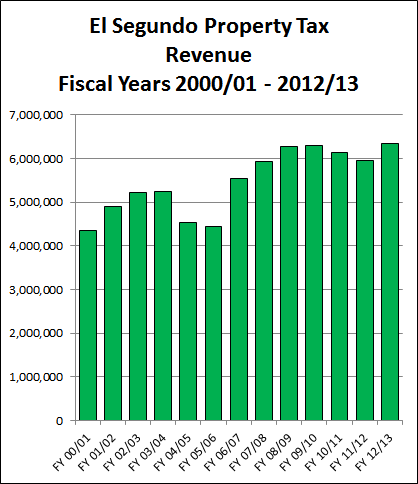

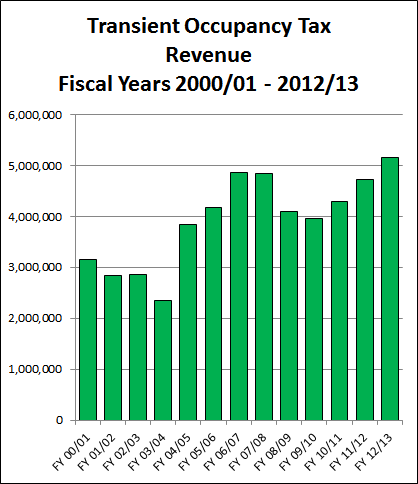

The El Segundo Firefighters’ Association (the official name of the firefighters labor union) is bankrolling the “Yes on Measure A” campaign to create four new permanent Utility Users Taxes (UUTs) on residents, nearly double the four existing business UUTs, increase the hotel Transient Occupancy Tax (TOT, or “bed tax”) by 25%, and create a new 10% parking tax.

The “Yes on A for El Segundo’s Future” campaign committee filed its first campaign finance disclosure form, FPPC Form 460 (“Recipient Committee Campaign Statement”), with the El Segundo City Clerk on March 3, 2014. It reports $12,500.00 in total contributions received, including $5,500 monetary contributions and $7,000 in nonmonetary contributions. The committee reported spending $10,266.64. Those are large amounts of campaign money for small-town El Segundo with a population of only about 16,720 residents and about 10,784 registered voters. And that is just the beginning of their campaign!

The two monetary campaign contributions were a $5,000.00 contribution from the El Segundo firefighters Political Action Committee (PAC) and a $500.00 contribution from Sandra Jacobs, the current chairman of the El Segundo Chamber of Commerce, and a former El Segundo Councilmember and Mayor who ran as one of three firefighter and police union sponsored City Council candidates.

Here are the data entries from the Schedule A of the Form 460:

| DATE RECEIVED |

CONTRIBUTOR |

AMOUNT RECEIVED THIS PERIOD |

CUMULATIVE TO DATE CALENDAR YEAR |

| 02/11/2014 |

El Segundo Firefighters PAC (#1231824)

P.O. BOX 55

El Segundo, CA 90245 |

$5,000.00 |

$5,000.00 |

| 02/12/2014 |

Sandra Jocobs

402 Hillcrest St.

El Segundo, CA 90245 |

$500.00 |

$500.00 |

Click HERE to view or download the “Yes on A” tax hikes FPPC Form 460 (536 KB PDF file).

Measure A will be decided by voters in the City of El Segundo, California on Tuesday, April 8, 2014. The El Segundo firefighter and police unions have much to gain in pay raises and increased pensions if Measure A passes. The two unions have a long history of endorsing, contributing money to, and campaigning for the City Council candidates and ballot measures that will put the most money in their paychecks and pensions, and then raise taxes and fees on residents and businesses to pay for it all.

The El Segundo firefighter and police unions have used this racket to ratchet up their total compensation to about $150,000 to more than $330,000 per individual per year.

The average 2009 firefighter annual individual total compensation was $211,000 and the maximum was $342,000 – before multiple large pay raises after 2009. The average 2009 police officer annual individual total compensation was $178,000 and the maximum was $304,000 – before multiple large pay raises after 2009. The firefighter and police managers get big pay raises when their subordinates get pay raises, to avoid “salary compaction”.

Police Chief David Cummings was given a 23% raise for his last year before retirement. As a result, he was paid a total of about $597,000 in 2009, the year he retired, in total Annual Compensation plus his CalPERS pension income while working half-time for 11 weeks as Police Chief after his retirement. His annual CalPERS pension income is now listed as $198,272.04 on the FixPensionsFirst.com web site.

The firefighter and police unions in El Segundo and other California cities have been pushing their city employers down the road towards bankruptcy. The City of Vallejo, California, is just one California city that filed for bankruptcy due to their firefighter and police unions.

Sandra Jacobs is one of two co-chairs identified on the “Yes on A for El Segundo’s Future” campaign committee website. The other co-chair is Joe Harding, who is also the treasurer of the Yes on A campaign committee. Harding was against the tax hikes before he was for them. He spoke out strongly against the tax hikes at the August 3, 2010 El Segundo City Council meeting when he was the General Manager of the Hacienda Hotel in El Segundo (HaciendaHotel.com). Now he is campaigning on the opposite side, for the tax hikes which hit hotels especially hard, as an ex-employee of the Hacienda. Here is an excerpt of what Harding said as a Hacienda Hotel employee:

“You must say ‘No’ to the hotel killer tax. … A TOT, and a UUT would hit us twice. That’d be like kicking us when we’re down, and then running us over for good measure. … The City must make unpopular and difficult adjustments to their payroll and expenses. Asking businesses to pick up the bill for the City and its residents in this economy is simply is not a fair approach. The Hacienda has been and will remain a stellar business in this community. Help make sure this continues. Leave the TOT where it is. It’s working for us. It’s working for the City. … Thank you.” – Joe Harding, General Manager of the Hacienda Hotel in El Segundo, speaking at the August 3, 2010 El Segundo City Council meeting, before he became an ex-employee of the Hacienda, flip-flopped, and became a co-chair of the Yes on Measure A committee to raise both the TOT and UUT taxes on the Hacienda and all other hotels and businesses in El Segundo, and to impose them on residents.

“Yes on A” campaign co-chair Sandra Jacobs last ran for City Council together with current Mayor Bill Fisher and former Mayor Eric Busch when they first ran for City Council. They were the three-candidate slate that the El Segundo firefighter and police unions endorsed, funded, and actively campaigned for.

Mayor Bill Fisher and former Mayor Eric Busch started their political careers in El Segundo with tremendous campaign support from the El Segundo firefighter and police unions, and rewarded them well with millions of taxpayer dollars.

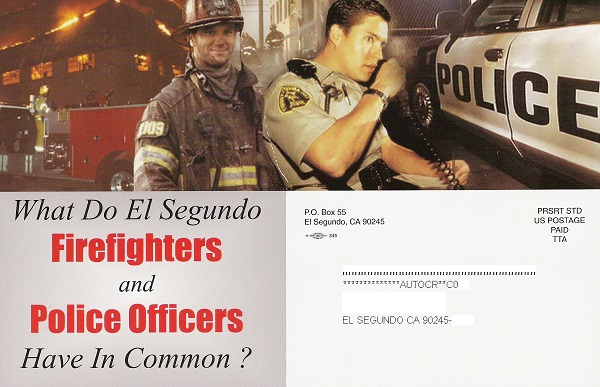

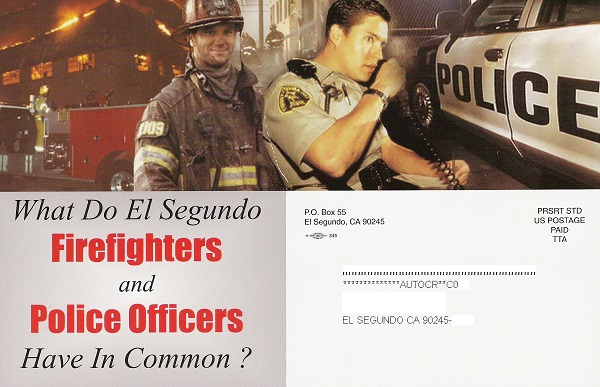

See the scanned images below of the campaign slate mailer postcard sent to El Segundo voters by the two unions.

The front side of the campaign mailer shows photos of a firefighter standing next to a fire engine and a police officer standing next to a police car. It reads:

“What do El Segundo Firefighters and Police Officers Have in Common?”

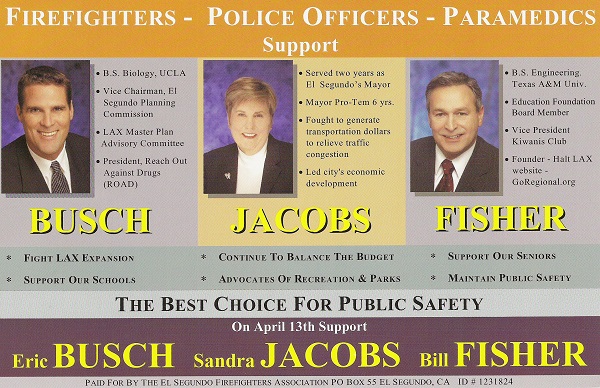

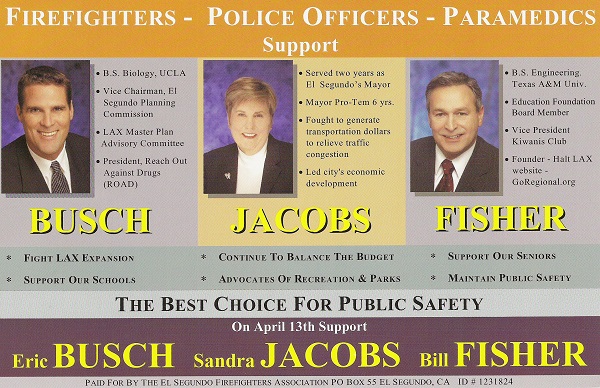

The back side has the photos and names of El Segundo City Council candidates Eric Busch, Sandra Jacobs, and Bill Fisher. It reads:

“Firefighters – Police Officers – Paramedics

Support

BUSH – JACOBS – FISHER

The Best Choice For Public Safety

On April 13th Support

Eric BUSCH – Sandra JACOBS – Bill FISHER

Paid For By The El Segundo Firefighters Association – PO Box 55 El Segundo, CA ID #1231824″

The firefighters and police unions claimed that they endorsed “The Best Choice For Public Safety”. That was a lie. They endorsed the candidates who would give them the biggest pay raises and pension increases, and then raise taxes and fees on the residents and businesses to pay for it all.

Click on each picture for a larger view. Then click on the BACK button in your browser to return to this web page.

When then Councilman Bill Fisher was confronted at a City Council meeting about the conflict of interest created from his firefighter and police union campaign support, given that he votes on their pay raises and benefits increases, he claimed he did not know the unions were supporting his campaign!

Notice how the firefighter and police union campaign slate mailer has professional studio photos with color-coordinated matching backgrounds of Bill Fisher and the other two union-endorsed candidates. Clearly, Fisher posed for his professional photo and a copy of it was sent to the unions for use in their campaign mailer. Also, Fisher wants us to believe he did not know who was distributing, installing, and maintaining his campaign signs around the city throughout the his campaign.

Either Bill Fisher is lying, or he is too incompetent to hold any elective office. In either case, is not fit to hold a position of public trust and to be entrusted with spending more than fifty million of our tax dollars every year.

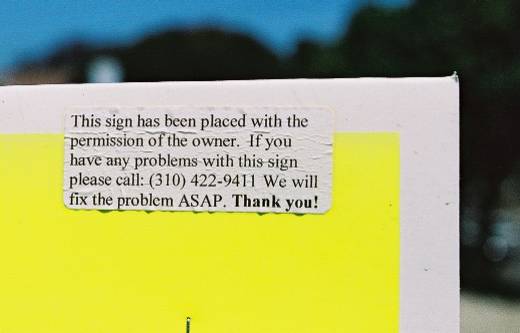

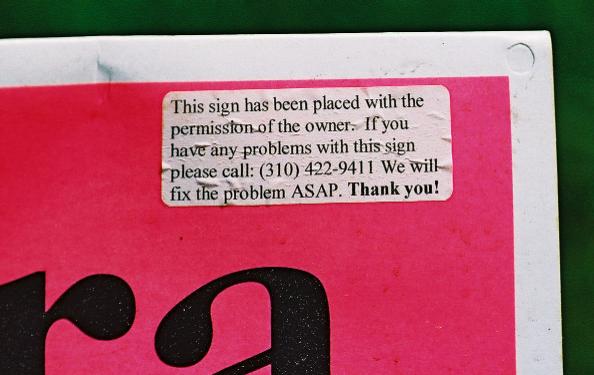

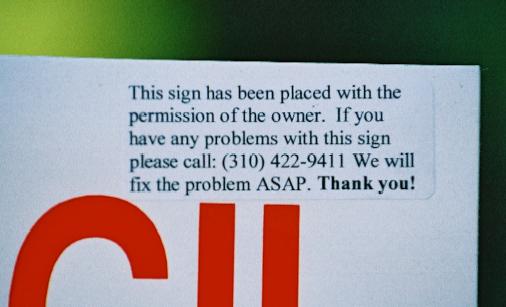

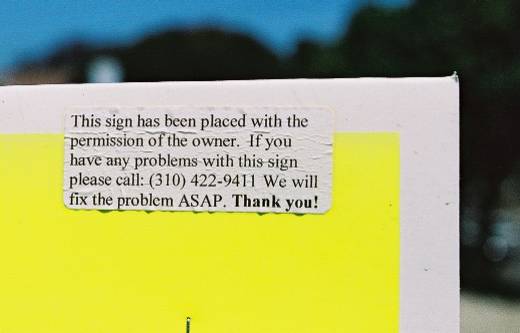

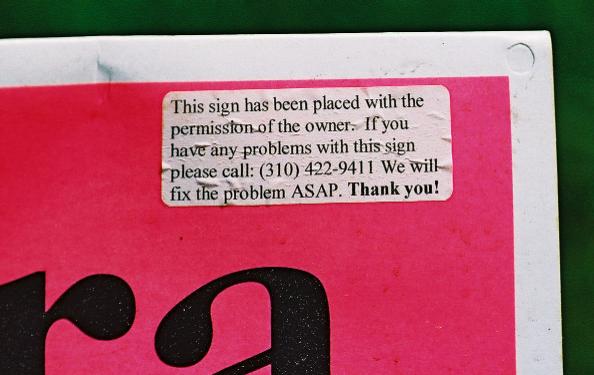

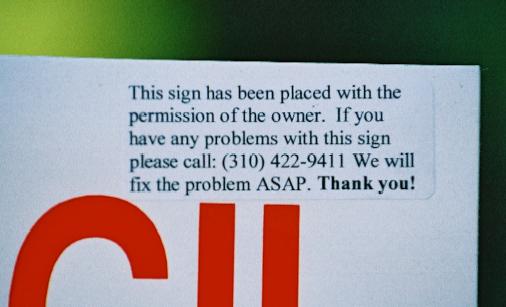

Firefighters union president Kevin A. Rehm managed the delivery, installation, and maintenance of the campaign yard signs for all three candidates – Sandra Jacobs, Bill Fisher, and Eric Busch. A sticker appeared on every sign with his cellular phone number. It read:

“This sign has been placed with the permission of the owner. If you have any problems with this sign please call: (310) 422-9411 We will fix the problem ASAP. Thank you!”

I called that number during the election campaign and Kevin Rehm answered. I spoke with him and asked him questions about the firefighter union’s candidate endorsements. You can do an Internet search for the following keywords to see that this is Kevin Rehm’s phone number: (310) 422-9411 Kevin Rehm.

Kevin Rehm’s annual CalPERS pension from working as an El Segundo firefighter is $172,516.08 per year according to the CalPERS Database on the FixPensionsFirst.com website at:

http://www.fixpensionsfirst.com/calpers-database/?first_name=&last_name=&employer=EL+SEGUNDO

See the photos of the three candidate’s campaign signs with firefighters union president Kevin Rehm’s cellular phone number on them below. The first two photos show the entire signs at a distance to make it clear the close-up photos of the sticker on the corner each sign are of the same campaign signs.

The El Segundo firefighters union installed triple the campaign signs for City Council candidates Sandra Jacobs, Bill Fisher, and Eric Busch at a house on the east side of town.

The El Segundo firefighters union installed double the campaign yard signs for City Council candidates Sandra Jacobs, Bill Fisher, and Eric Busch at a house on the east side of town.

See the photos below of the campaign signs with firefighter union president Kevin Rehm’s cellular phone number (310-422-9411) on them as the sign placement and maintenance coordinator. His phone number sticker was on all the signs for Eric Busch, Sandra Jacobs, and Bill Fisher.

Bill Fisher’s City Council campaign sign with El Segundo firefighter union president Kevin Rehm’s cellular phone number on it.

Sandra Jacobs’ City Council campaign sign with El Segundo firefighter union president Kevin Rehm’s cellular phone number on it.

Eric Busch’s City Council campaign sign with El Segundo firefighter union president Kevin Rehm’s cellular phone number on it.

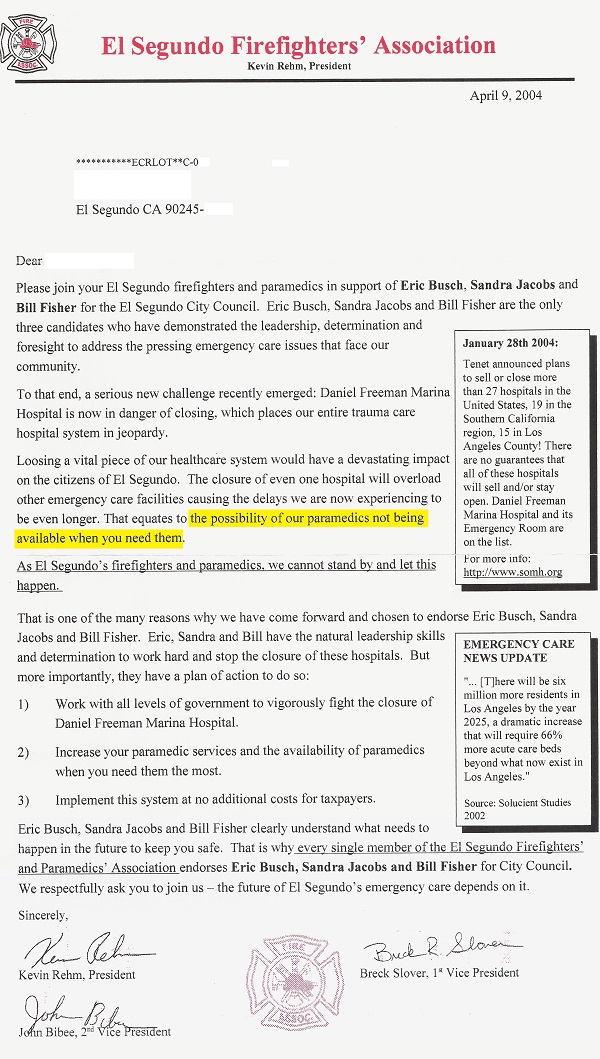

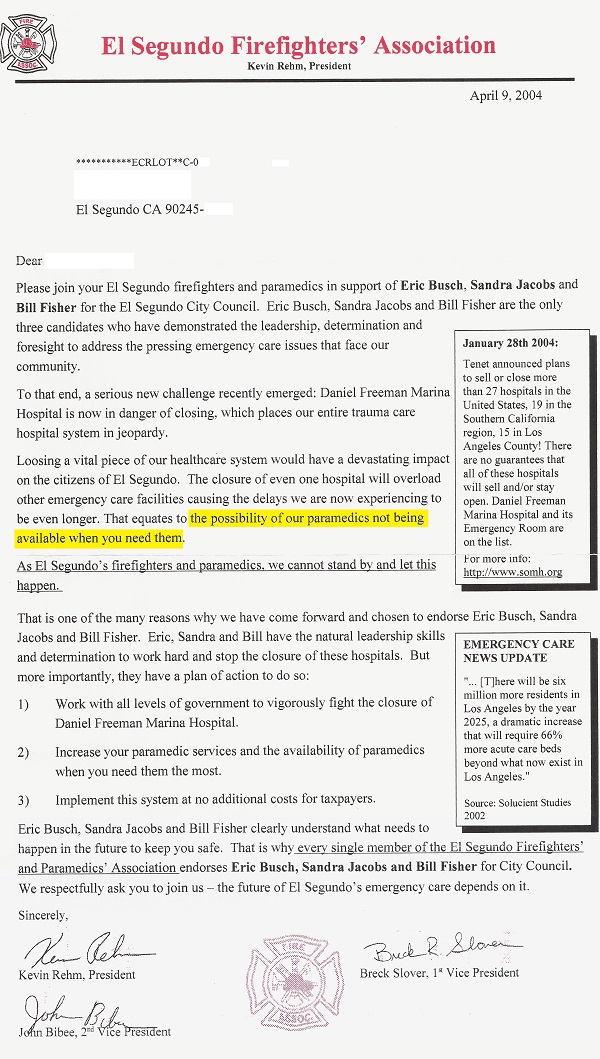

The El Segundo firefighters union even sent out a campaign letter on their official union letterhead, signed by union President Kevin Rehm, 1st Vice President Breck Slover, and 2nd Vice President John Bilbee, threatening senior citizen voters with “the possibility of our paramedics not being available when you need them” if the three candidates approved by the union were not elected!

See the scanned image of this letter and the envelope it was sent in below.

Click on the letter below to see a larger image of it, then click the BACK button in your browser to return to this web page.

Click HERE for an analysis and the text of the Senior Scare Letter on our old web site. Then click the BACK button in your browser to return to this web page.

El Segundo Police Officers' Association (ESPOA) Exposed

El Segundo Police Officers' Association (ESPOA) Exposed