by Michael D. Robbins

Director, Public Safety Project, PublicSafetyProject.org

March 8, 2014

The El Segundo Herald, a small town newspaper in Southern California, misreported the City’s $6.3 million annual property tax revenue as “about $1 million”. A correction is in order. Given that gross understatement of property tax revenue, voters may vote for Measure A, a massive tax hike on the April 8, 2014 City election ballot that will cost residents and businesses an estimated $6.6 million each year in its first three years. All residents will pay the business taxes that are passed on to them as customers.

According to the March 6, 2014 Herald article, Council Holds Off on Rec and Parks Fee Decision, by Brian Simon:

“Responding to comments from former Councilmember Mike Robbins about the City’s property tax revenues being at an all-time high, Fisher responded that those dollars still only amount to two percent of the general fund, or about $1 million annually. El Segundo receives 6.2 cents on the dollar for its share of property tax revenues, compared to a County average of about 11 cents.”

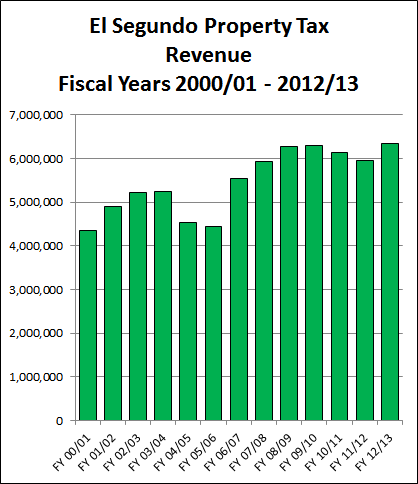

That is a strange mistake, given my statements during Public Communications at the March 4, 2014 Council meeting that El Segundo property tax revenue for fiscal year 2012/13 was at a record high of $6.3 million, and that I posted an article with a bar chart showing El Segundo property tax revenue going back to fiscal year 2000/01 at PublicSafetyProject.org, in the article titled, Wrong Time to Raise Taxes and Fees in El Segundo. That article includes a table with the revenue data used to create the bar chart, and a link to the City Hall document from which the data was obtained.

Here’s that bar chart:

It’s worth noting that property values in El Segundo are probably significantly higher than most other cities in Los Angeles County, which helps compensate for the lower percentage of property taxes coming back to El Segundo compared to the average for cities in the county. The fact that property tax revenue is at a record high level shows property taxes are not the cause of Fisher’s budget deficits. Fisher gave big pay raises to City employees every year since the Great Recession began, including big retroactive raises. Those raises ratcheted up employee compensation and pension costs, and far exceeded the mostly temporary one-time employee concessions.

Mr. Simon went on to write:

“Fellhauer pointed out that property tax revenues don’t even cover the cost for the City’s smallest department (the Library at $2 million a year).”

I suggest to Councilwoman Marie Fellhauer that if Mayor Fisher gets re-elected on April 8 and keeps giving the City unions excessive pay raises, there may come a time when a million dollars won’t pay for a few firefighters or police officers in El Segundo. The highest paid ones get more than $300,000 per year in total compensation.

I submitted the letter below to the editor of the El Segundo Herald, to correct their misinformation and properly inform voters before they vote. However, El Segundo Herald CEO and President Heidi Maerker arbitrarily rejects letters without explanation and avoids and refuses to respond to inquiries. Let’s see if she prints this one!

It meets all of their published standards, except for the arbitrary undisclosed ones Heidi decides but won’t reveal.

The Herald prints very few letters now, perhaps a sign it’s barely hanging on to a fiscal cliff, kind of like Mayor Fisher who won’t roll back those excessive pay raises of up to 32 percent. Residents have told me they stopped reading the Herald because they rarely print letters, and the free newspapers can be seen turning yellow and collecting mold in people’s front yards and driveways.

If this sounds like sour grapes, no – it’s more like moldy newspapers. The Herald used to be a showcase for vibrant and often well-written letters from all points of view, especially during election campaign season. The Letters section used to be the best section of the paper, and many residents told me they read it first. It was part of our small town atmosphere, and a way to get information not covered in the news.

But as the Internet grows, newspapers big and small struggle to survive. Some are a victim of the economic and environmental policies they advocated, and of their alienation of much of their potential audience and customer base.

El Segundo residents can get city and election related news and information they won’t find in the newspapers at PublicSafetyProject.org. Information like the following, first publicized here at the grassroots level:

In 2009 the average annual individual El Segundo firefighter total compensation was $211,000 – and the maximum was $342,000 – before multiple large pay raises after 2009. And the average 2009 police officer annual individual total compensation was $178,000 – and the maximum was $304,000.

Letter to the EL Segundo Herald, by Michael D. Robbins, submitted via email on Thursday, March 6, 2014:

A Correction is In Order

The 3/6/14 Herald article, “Council Holds Off on Rec and Parks Fee Decision”, contained misinformation. City property tax revenue is more than $6 million – not about $1 million as the author misinterpreted from Mayor Fisher’s obfuscation.

The property tax revenue numbers I cited at the 3/4/14 Council meeting are from official City of El Segundo public record documents and are presumably correct. Based on those documents, I stated during the meeting that El Segundo property tax revenue for fiscal year 2012/13 was more than $6.3 million, is at a record high for at least since FY 2000/01, is 46% and about $2 million higher than FY 2000/01, has had an average annual increase of 3.6% and more than $166,000 per year, and has increased in 9 of the last 13 fiscal years.

See the article, “Wrong Time to Raise Taxes and Fees in El Segundo”, at PublicSafetyProject.org. In includes a bar chart showing property tax revenue from FY 2000/01 through 2012/13, the data for that chart, and a link to the City public record document that is the source of that data.

Fisher wants voters to believe property tax revenue is to blame, not big pay raises. Fisher’s number only includes residential property tax revenue to minimize tax revenue and because of his misguided and unsound belief that residents don’t pay enough taxes. Residents pay business taxes that are passed on to them as customers, and defense contractors are paid from our federal income taxes.

Mike Robbins

NOTE: Heidi Maerker at the El Segundo Herald printed the above letter in the El Segundo Herald on Thursday, March 13, 2014, on page 7, but she omitted the third paragraph because she does not want letters to contain any web links.

El Segundo Police Officers' Association (ESPOA) Exposed

El Segundo Police Officers' Association (ESPOA) Exposed